|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

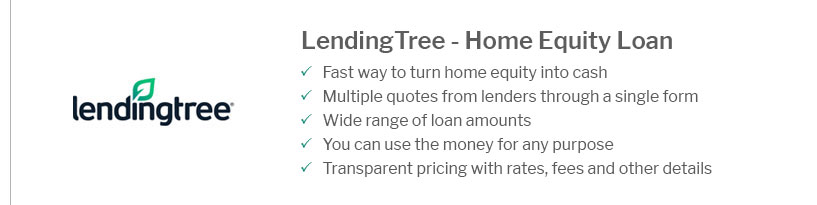

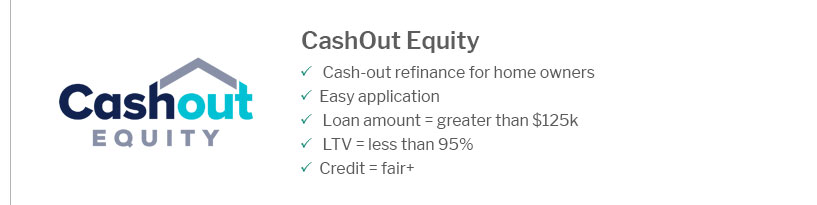

Why Refinance Your Home: Key Reasons and BenefitsRefinancing your home can be a strategic financial decision with multiple benefits. It involves replacing your existing mortgage with a new one, usually with better terms. Homeowners often consider refinancing for various reasons, ranging from reducing monthly payments to accessing home equity. Lower Interest RatesOne of the primary motivations for refinancing is to secure a lower interest rate. A reduced rate can significantly decrease your monthly mortgage payment and the overall interest paid over the life of the loan. Impact on Monthly PaymentsLowering your interest rate can have a substantial impact on your monthly payments. This allows homeowners to allocate funds to other financial goals. Accessing Home EquityRefinancing can allow you to tap into your home’s equity, providing a financial resource for large expenses or investments.

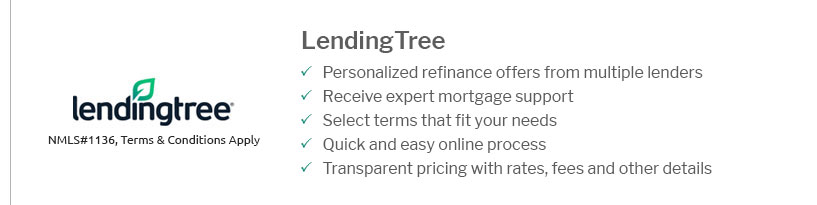

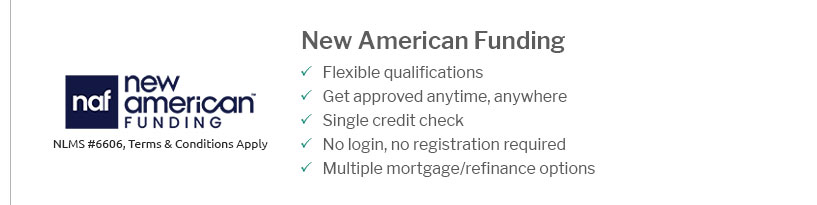

Changing Loan TermsRefinancing offers the opportunity to adjust your loan terms to better suit your current financial situation. Switching from Adjustable to Fixed RateHomeowners may choose to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage to achieve more predictable monthly payments. Shortening Loan TermOpting for a shorter loan term can increase monthly payments but will reduce the total interest paid and help you own your home sooner. Finding Reputable PartnersWhen considering refinancing, it’s crucial to work with reputable mortgage refinance companies to ensure you receive the best possible terms and avoid potential pitfalls. FAQsWhat is home refinancing?Home refinancing involves replacing your current mortgage with a new one, often to secure a lower interest rate or to change the loan terms. How do I know if refinancing is right for me?Consider your financial goals, current interest rates, and how long you plan to stay in your home. Consulting with reputable mortgage refinance lenders can provide guidance tailored to your situation. What are the costs associated with refinancing?Refinancing typically involves costs such as appraisal fees, closing costs, and application fees. It's important to calculate whether these costs are offset by the savings from a lower interest rate. https://www.equifax.com/personal/education/loans/articles/-/learn/should-i-refinance-my-mortgage/

Mortgage refinances can help homeowners save money by lowering their monthly housing cost, or by reducing their interest rates and improving the terms of their ... https://www.investopedia.com/terms/r/refinance.asp

Refinancing a loan or mortgage is typically done to take advantage of lower interest rates or improve the loan terms, such as the monthly payment or length of ... https://www.cnbc.com/select/pros-and-cons-of-refinancing-home/

Refinancing your mortgage may be able to give you some breathing room by lowering your monthly payments and/or saving you money over time. At the same time, ...

|

|---|